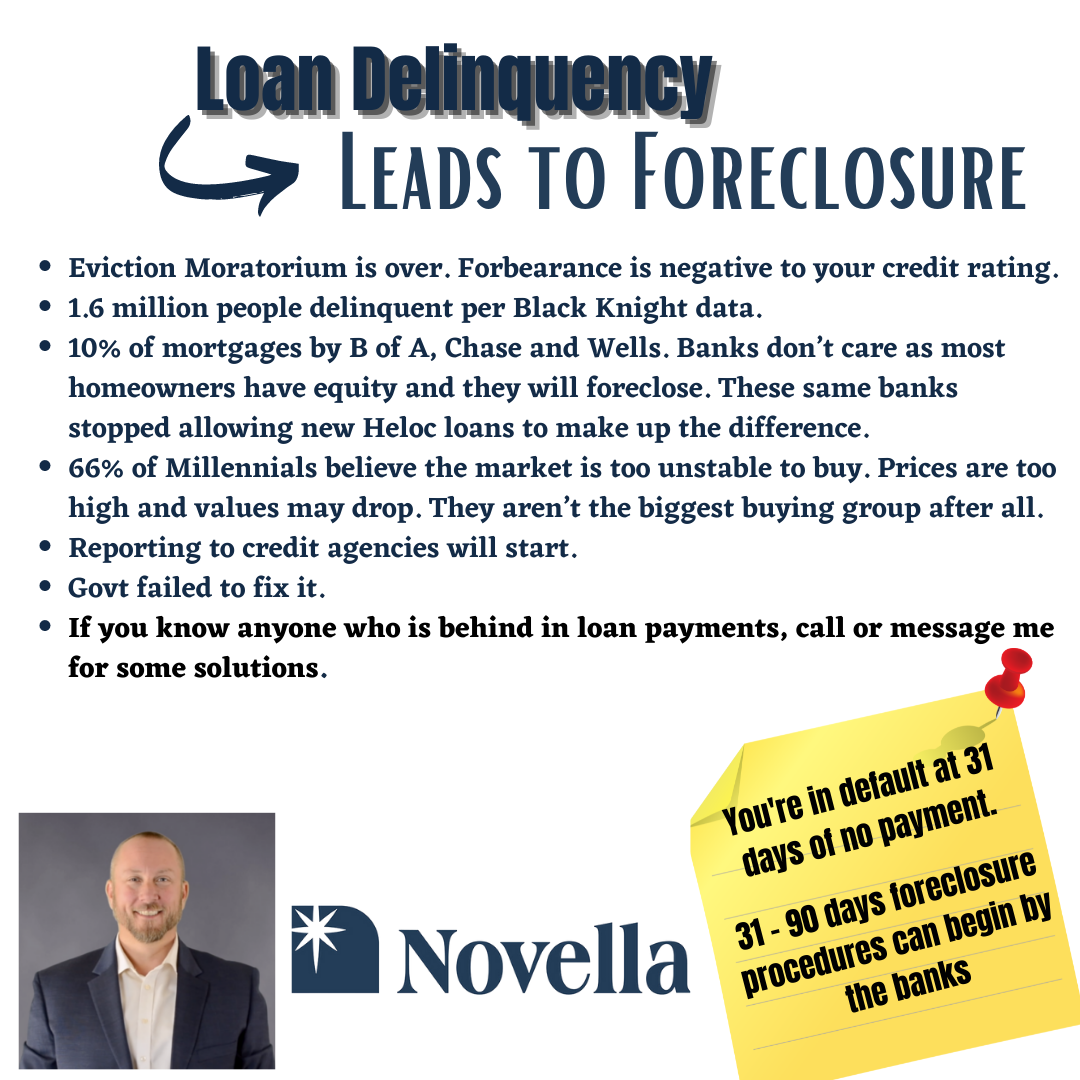

Just think about it for a minute, if you havent made any payments to your mortgage loan for one month or 18 months, and the govt isnt going to stop the banks from collecting the money you owe them, do you think the banks wont collect? The banks surely will! And since it isnt 2007-2008 anymore, at which time back then most people were over leveraged on their homes and had no equity, the banks didnt want to kick anyone out hoping they could collect some monies. Now, in 2021, most homes have lots of equity. Banks will not hesitate to start foreclosure proceedings as soon as you as the borrower are in default.

Default means you have not made a mortgage payment in over 31 days. Why would banks want to start foreclosure and kick you out? Becuase they want their money back! The banks will foreclose on you and sell your house for at least what you owe them, and maybe some of your equity. It depends on the banks and the respective State laws governing foreclosure. Do you think the bank will then be nice and cut you in for your share of the equity after you essentially stiffed them and didnt pay them their monthly payment…the answer is no!

If you were in forbearance, which is esentially not paying your mortgage due to covid, do you think the banks wont treat you as a regular foreclosure receipient? Of course they will, think about it? The govt kept the banks in check but that moratorium is over. If your more than 31 days over due whether from traditional “not paying your mortgage” or through “forbearance” for more than 31 days, your in default. If your in default, the banks can foreclose on you.

Now if you didnt lose your job and or income and can qualify for a second mortgage, refinance, loan modification, Heloc etc, then great! You can use those tools fix your financial situation. But if you lost your job and are scraping by, you may not qualify financially to change your mortgage or let you catch up, therefore,the banks will foreclose on you and you risk losing all or a hefty portion of your equity. The bank wants what is owed to them, they dont care much about your equity.

You do have some options if you fall into this category and find yourself not sure, confused, or trapped. Its very dependent on each person or family situation. Call, email, or message me to learn your options and put the decision making and power back into your hands. grant@novellaliving.com or 303.908.1330.